The Great Race

On the Race for Global Dominance

Imagine a never-ending ship race around the world—The Great Race—a metaphor for the global economy. All countries compete, with each limited to one ship and only allowed to use the technology available within their borders to build and operate it.

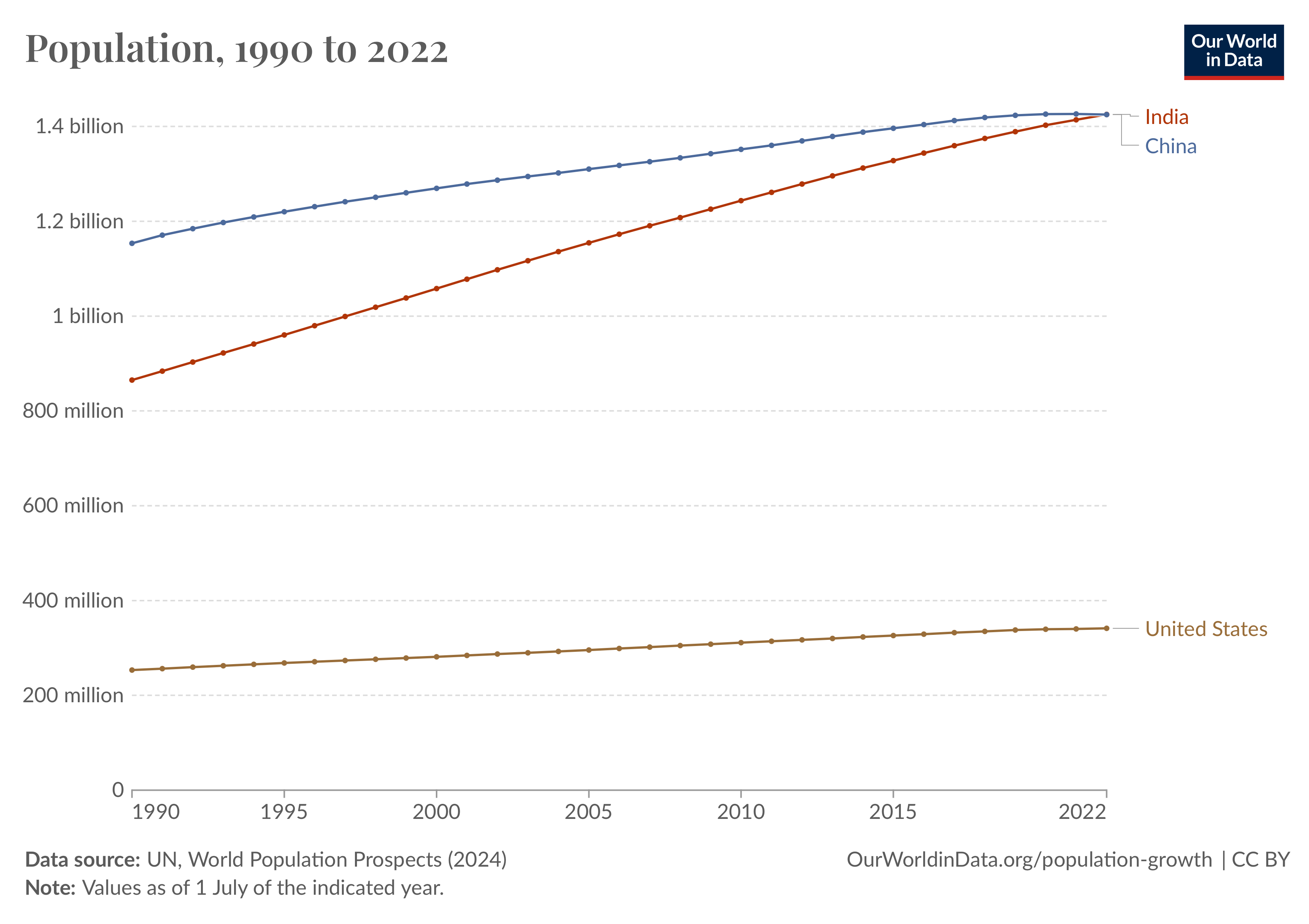

Each country is entitled to one team member per million citizens. The U.S. has about 340 million people, so we can have a crew of 340. China gets 1,430, given its current population size is about 4 times ours.

At about the same technological level, countries with larger populations perform better in The Great Race because they have larger crews. If two nations use oar-powered boats, the nation with a greater population can have more rowers.

Throughout history, even as new technology developed, some civilizations were left behind in terms of technological know-how. For example, some civilizations still used oar-powered boats while others moved on to sail-powered ships, and so on. This know-how disparity means higher-technology countries can easily outpace lower-level technology countries in The Great Race, even if the lower-technology countries have much larger populations.

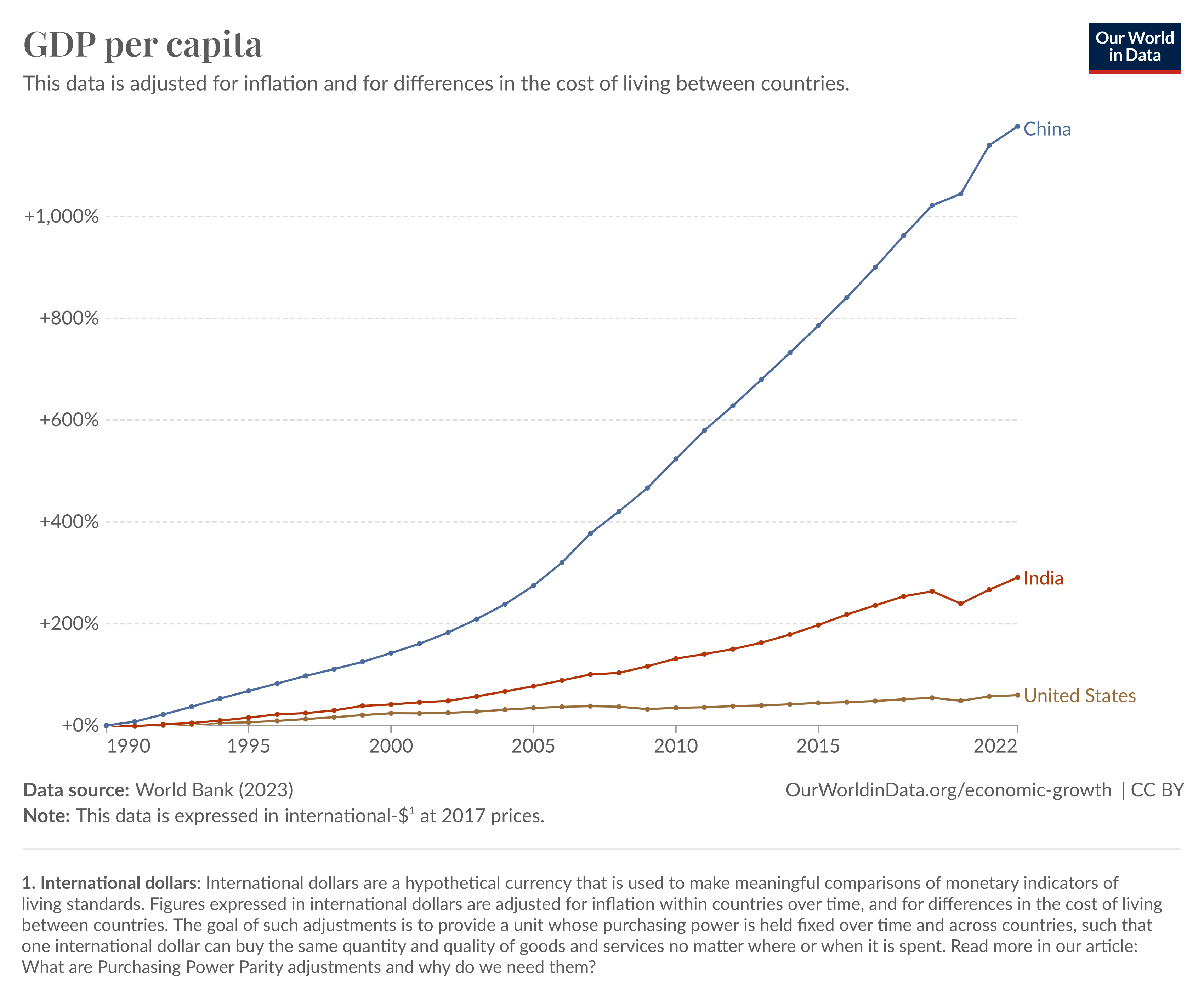

That’s because superior technology enhances productivity: Steam-powered ships will outpace oar-powered boats across the ocean, regardless of how many people row. This is how America can lead in The Great Race (and by extension in the global economy) even though we have far fewer people than nations like China or India: through advanced technology. Our workers produce more per person; we possess nuclear-powered surface vessels.

OK, but why does this all matter? It matters because if you are outright winning The Great Race—meaning you have the biggest economy by far—then you have tremendous global soft power. Everyone wants to trade with you for your superior technology. They also want to invest in you, elevating your currency to the highest status.

All this money flowing in means you can easily outspend everyone else on military and technological dominance, maintaining your lead. The increasingly advanced technology you’re inventing and commercializing also means that your citizens are continually upgrading their jobs and standard of living, using the new technology at work and at home.

This portrait of a globally dominant superpower describes America in the 20th century. However, our ascendency, as measured by our share of the global economy, peaked over 50 years ago in the 1960s. While it has fluctuated over shorter periods since, the overall long-term trend has been that our share has steadily declined to about half its peak.

Over this same period, China has risen to the extent that over the past decade we’ve been neck-and-neck in The Great Race, with the size of our economies now roughly equal. As this happened, our power to exert control over global events and our ability to generate continuous increases in standard of living have consequently diminished. It should, therefore, come as no surprise that armed conflicts have increased internationally, and domestically, the American Dream has become harder to attain.

But it can get worse from here. China’s much bigger population means they will have a much easier time generating a bigger economy relative to us. All they have to do is maintain about the same level of technological know-how; with the same types of ships in The Great Race, they can easily outpace us with their larger crew.

While it is entirely unknown what China will do in the future with different leadership, we can't rule out some potentially terrible things, like China deciding they can start taking over other countries when a relatively much weaker America cannot do much to stop them.

According to the projections below, China’s economy could potentially double ours as soon as 2050. Unless we start consistently matching their growth rate, this doubling is only a matter of time—if not by 2050, then sometime after.

Perhaps China waits until its economy is triple ours, putting them way ahead in the Great Race like we once were. At that time, they could easily outspend us on military and technological dominance. I would then expect China to make at least one major technological breakthrough years ahead of us that they could use to win wars. After all, that’s what we did with nuclear weapons in World War II, and which has happened many other times throughout history with other novel technologies at the time, like airplanes, guns, etc.

One or more key future technologies, such as artificial superintelligence, quantum computing, humanoid robots, space tech, etc., will likely afford the leader a significant military advantage. What if China becomes years ahead of us in all these critical technologies? Let it sink in that this is what we were to China just a few decades ago.

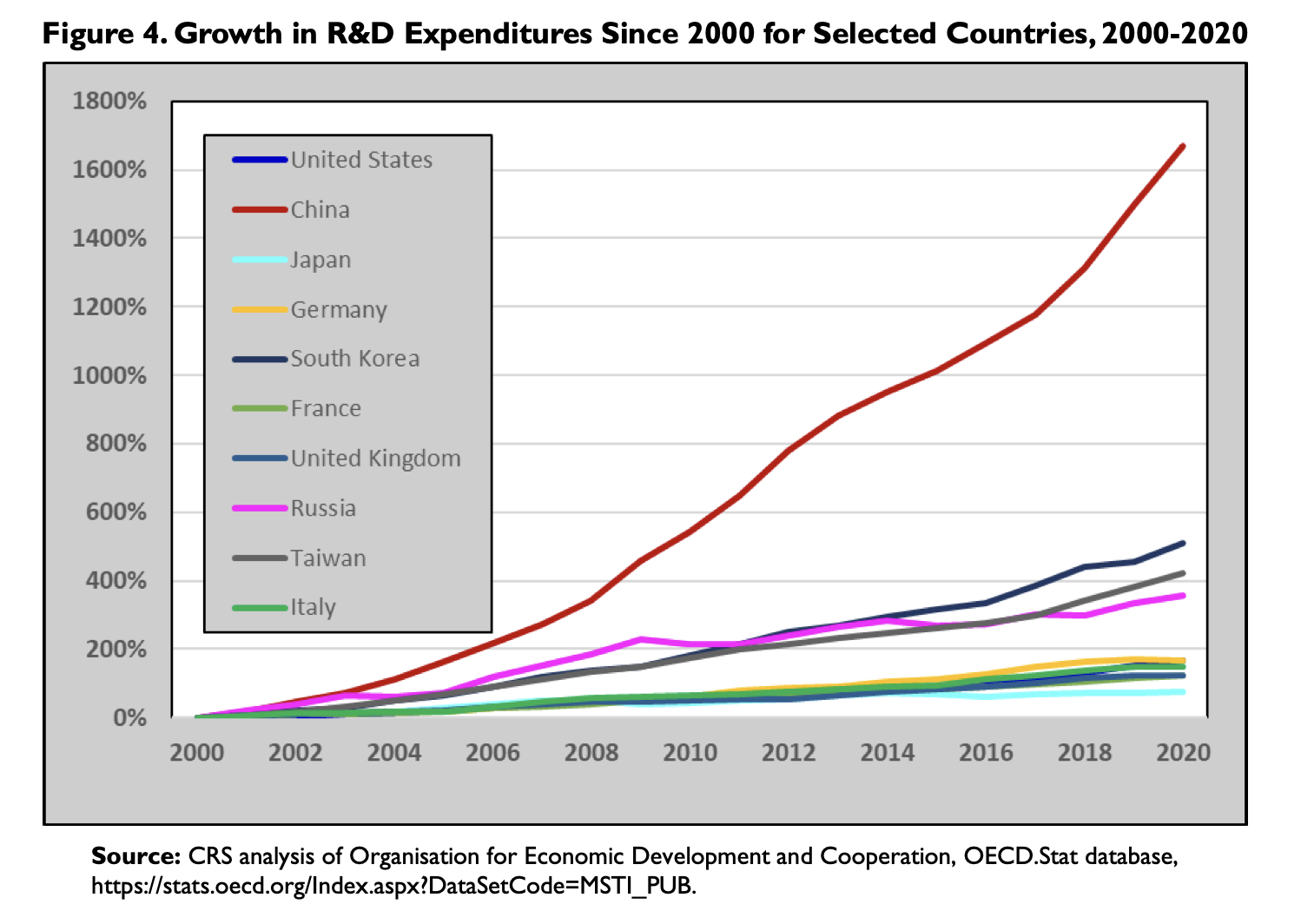

Unfortunately, China has already realized that technological dominance is the key to winning The Great Race in the 21st century and started ramping up its investment in research and development around the turn of the century. By contrast, we have not similarly ramped up our R&D spending in response. While U.S. industry has steadily increased investments, federal investments have not kept pace to keep us well ahead.

Vastly increasing U.S. government investment in innovation—subsidizing frontier scientific research and development—is critical because we need to be investing much more than China to get back out ahead in The Great Race. Today, industry investments are generally more directed towards shorter-term, profit-motivated activities and are nevertheless increasingly matched by similar Chinese companies. Empirically, our current level of federal investment is clearly way off, as evidenced by China's catch-up to us in both R&D spending and our position in The Great Race (size of economy).

The good news is that if we decide to invest appropriately, there is a lot of low-hanging fruit. For instance, the government receives far more high-quality scientific and innovation-oriented grant and loan applications than it funds, from labs seeking funding for fundamental research to companies seeking development funding to commercialize such research. Since they are all already reviewed for merit and need, a straightforward initial approach is to have an unlimited budget to fund any application that meets these thresholds. Such thresholds can also be tweaked to better ensure incrementality relative to industry investments and direction towards particular scientific fields and technologies. If we open the floodgates, more quality applications will surely flow through. The government doesn’t need to actually do the work; it just needs to incentivize and invest in it properly. And we can do much more once we fully commit to this path, like truly overhauling our tax and regulatory infrastructure to best cultivate innovation-seeking activities.

We should debate how best to invest and incentivize, but we must first embrace this fundamental truth: military and technological dominance demands decisive, continuous investment. We seem to get that for military dominance, but we’ve lost the script for technological dominance. We must recognize we are way off in our current quantity of technological investment and correct that ASAP. Quite simply, we need to be investing way more in R&D than China, like multiple times, and we are not doing so anymore.

To provide context, in 2022, total U.S. R&D investment reached approximately $900 billion, with China trailing closely behind. The federal government accounted for about $150 billion of this total. In the short term, the total U.S. R&D investment should at least double to more than $2 trillion, to more than double China’s investment. Suppose we assume half of this ~$1 trillion increase comes directly from the federal government and half from industry (matching/following government incentives/investment). In that case, we must allocate ~$500 billion more annually in federal R&D investment today.

But won't significantly increasing our federal R&D expenditure also significantly increase our deficit, putting us even more in debt? No, because by investing in innovation, we are ultimately making our economy grow much faster than it would otherwise—that is the point of the investment. So, if we are successful, then, like any successful investment, we will get a positive return. Therefore, the deficit will actually decrease long-term by the amount of this return, with all other things being equal. Of course, we could also use the extra money for anything we see fit at the time, including paying down debt. Put another way, increasing our innovation budget to the needed level is not at odds with making the government more efficient; in fact, it is aligned with that goal.

Even though it may be hard to see up close in the sea of our daily news and yearly political cycles, zooming out, America is right now at a fork in The Great Race. On one side is calmer water—the status quo. We can easily move forward on this path relatively slowly, falling further behind in the race. This path is the well-traveled one of many nations and civilizations before us that, too, faded from their prime, ultimately finding no way to catch up. On this path, we will still be important on the world stage, but our hegemony is over and will likely be ceded to China; we will continue to complacently let our economic power and global influence erode, slowly but surely.

Or, we can refuse this fate and chart a different path through admittedly much choppier but faster-moving waters. We can return to directly investing in our long-term future at a magnitude not seen since the Space Race in the 1960s. As I explain in more detail below, this is the only realistic way to start growing our economy significantly faster than China again, giving us the fuel to stay well ahead in The Great Race for the rest of the century.

Military protection is a strong motivation, but it is not the only one. Perhaps the greatest motivation could be reversing the slipping away of the American Dream. Investing in technological dominance means creating higher-paying jobs that utilize the new technology being developed. These are the "better jobs" that everyone is always talking about. We need to navigate towards this promised land. That is, the same investments that can secure our military future can also secure our domestic future, increasing our collective standard of living. However, if we let China get way ahead in The Great Race, then those better jobs will materialize there, not here.

In any case, we can’t afford to wait anymore. Once China’s economy is double or triple ours, trying to keep up with their spending will continually strain our economy, similar to the U.S.S.R. before its collapse, with simply too much of its economy steered toward military ends. The point of no return is nigh.

That said, even if you don’t care about China and its position in The Great Race relative to America, this issue should still be extremely important to you personally. Here’s why: From 1970 to the present, our economy per person (GDP per capita) has grown at about 1.75% per year. If we had grown just 1% faster, at 2.75% instead, then GDP per capita would be about 66% higher than it is now. We’re currently at about $65,000 per person, which means it could have been $108,000 if we had maintained the higher growth rate. That’s a huge difference. On average, we could all be making 66% more, but we’re not because we didn’t invest in innovation enough to get that extra percent.

And even if you think that’s great but care about another issue more, consider that increasing our economy through innovation will not diminish your issue; in fact, it will help it: Faster growth means a bigger economy with better jobs. Better jobs mean a higher standard of living, which means more tax dollars to fund your issue. Growing the economy makes the pie bigger; it doesn’t take away a slice from something else.

In other words, investing more in innovation is as close to a no-brainer as you can get regarding government policy. If done correctly, it pays for itself by definition and secures our domestic and international future. So why aren’t we doing it already? We do, of course, but just not enough of it. I think the primary reason is that it is a long-term return over decades, and our politics and policies have tended to operate on much shorter-term time horizons over years. Presidents aren’t typically rewarded for increased innovation investments because they're usually out of office when the return materializes.

I don’t know how to correct that, but we must. Historically, we’ve done that in the face of a formidable adversary, such as the Manhattan Project in World War II and the Space Race in the Cold War. And we’re in a similar situation again now with China, whether we’ve fully realized it or not. We shouldn’t need to be in a situation like this to make such investments. We should have been doing it continuously, but if that’s what it takes to make progress, I’ll take it.

On the Numbers

I realize many people stop reading when you start getting into math, so I put the primary argument upfront. Still, I suggest you bear with me because I promise this is simple, brief, and illuminating. The size of a country’s economy, and therefore its current position in The Great Race, can be boiled down to just one multiplication:

Economy = Population x Economic output ($) per person

- Example: $50 billion = 1 million people x $50,000 per year

- Example: $5 trillion = 100 million people x $50,000 per year

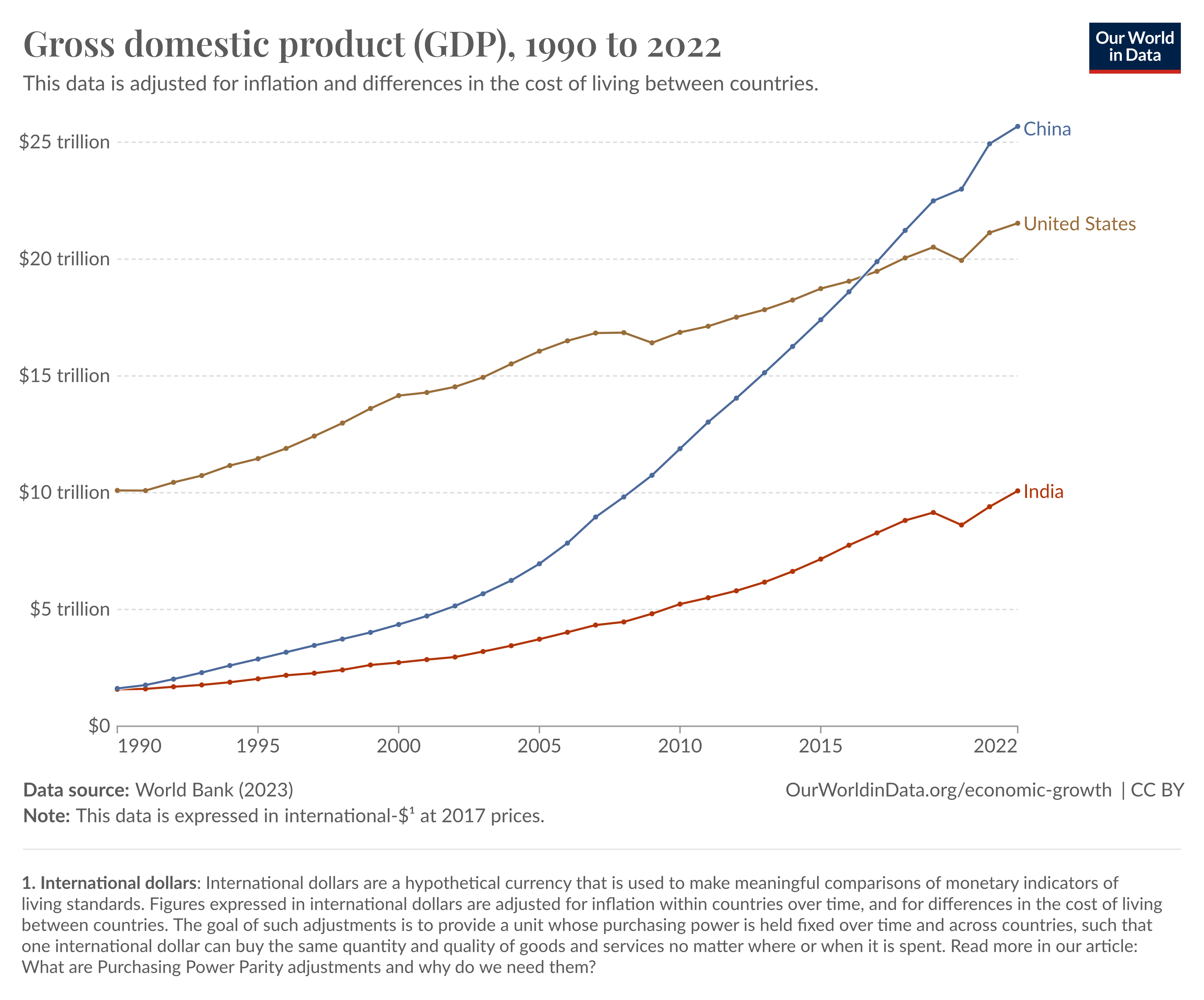

Here is a table of recent, actual data from the World Bank (via Our World in Data) for the U.S., China, and India. It compares these countries’ economies by using “international dollars,” which economists use to account for the differences in prices of similar goods across countries, including inflation. (I acknowledge that there is no perfect way to make these cross-country adjustments, but all the standard methods produce directionally similar results.)

| 2022 | U.S. | China | India |

| Population | 340 million | 1.4 billion | 1.4 billion |

| $ per person | $65 thousand | $18 thousand | $7 thousand |

| Economy | $22 trillion | $26 trillion | $10 trillion |

China has slightly more than four times the population of the U.S. but only slightly more than one-fourth of the economic output per person. Hence, China’s economy is about the same size as the U.S.'s since 4 x ¼ = 1.

That’s how, numerically, China is neck-and-neck with us in The Great Race. The following graphs show how this happened.

China’s population grew much faster than ours.

So did China’s economic output per person (GDP per capita).

When these inputs multiply to determine the size of overall economies (and therefore race positions), we see that China’s economy progressed much faster overall.

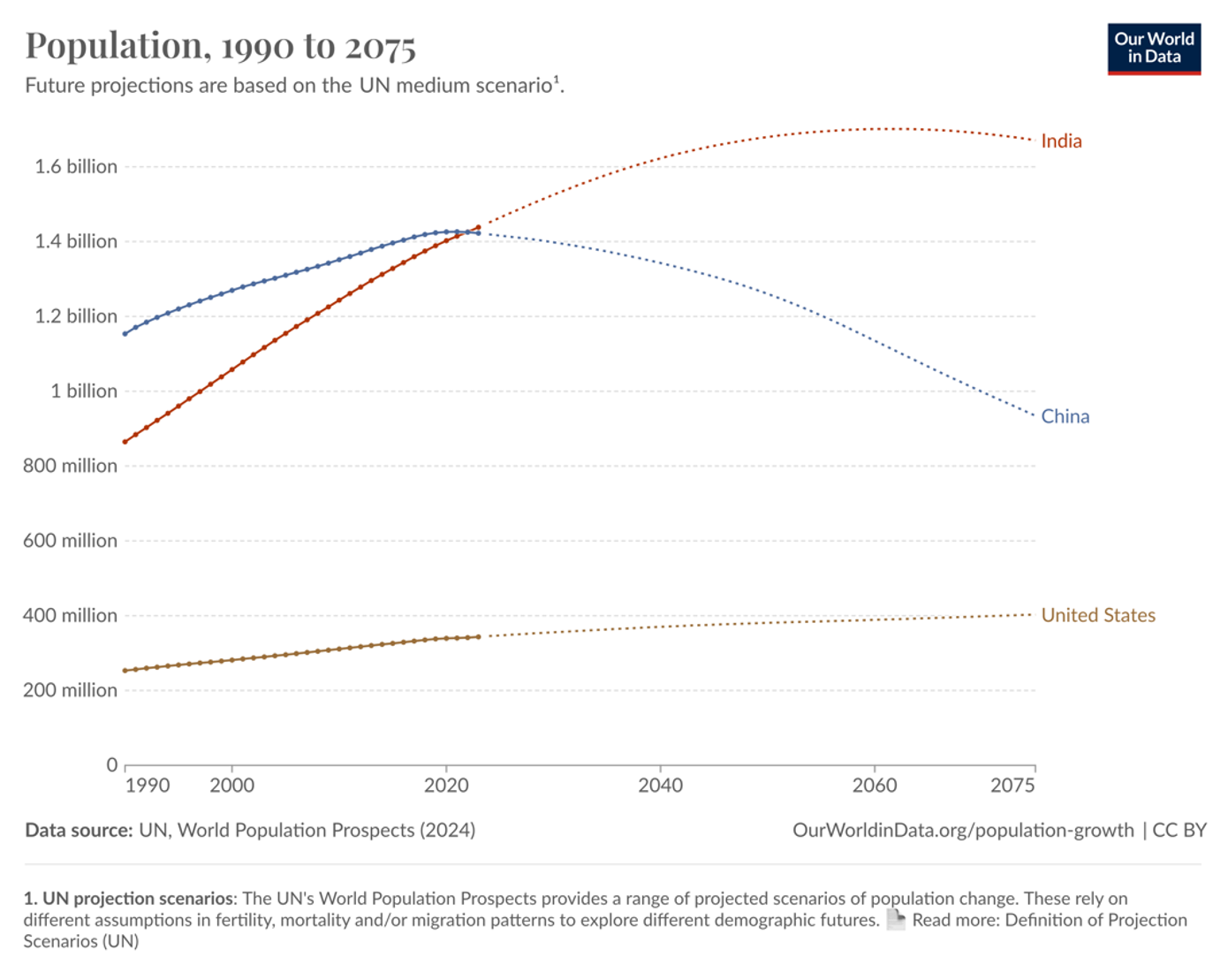

These historical trends aren’t good for America, but what about the future? The UN's population projections predict that China and India will have at least 2 to 4 times America’s population in the next 50 years. That is, they will continue to have much larger crews.

Projections for economic output per person predict that China’s growth will slow but still significantly outpace ours. Acknowledging that these are estimates based on such predictions, reasonable growth ranges for economic output per person are the U.S. at 1-3%/yr, China at 2-5%/yr, and India at 3-6%/yr.

If these ranges persist for the next 25 years, then by just around 2050, we could realistically face a Chinese economy double America’s, and America’s economy could also be significantly smaller than India’s:

| 2050 | U.S. | China | India |

| Population | 381 million | 1.26 billion | 1.68 billion |

| $ per person | $85-$113 thousand | $42-71 thousand | $22-38 thousand |

| Economy | $33-56 trillion | $40-90 trillion | $27-61 trillion |

The economic ranges are large because future policies can alter growth rates, and even small changes in growth rates can compound over time. The mathematical reality of this compounding means that unless we begin to match the growth rates of China and India, a grim future where both are far ahead of us in The Great Race is merely a matter of time. If not by 2050, then at some point later this century.

On Facing the Numbers

I see only one viable way to navigate the uncharted path in the face of these numbers: restoring America’s technological dominance.

Recall that the governing equation for position in The Great Race has just two inputs: Size of Economy (position) = Population x Economic output per person. Therefore, we need some combination of significantly increasing our population size or our economic output per person, relative to China.

We need to act quickly because, according to the numbers above, in the next 25 years we will likely need to double our overall growth rate (speed in the race) to start outpacing China, which is certainly a tall order. This means, in addition to what we’re already expected to do, we would have to roughly double our population size, double our economic output per person, or find some combination that achieves the same.

Unfortunately, there is no realistic path to increasing our population so much in this limited timeframe. Our birth rate has been steadily declining for 65 years. While it may be possible to reverse this trend in the medium-term through cultural changes reinforced by government policies, the best we can hope for in the short-term is that the average number of children starts to rise from about 1.6 to at least 2.1 (about a 30% increase). At that level, our birth rate won’t work against us as it does now, leading to a net decrease in population that we need to compensate for through immigration.

Immigration is, of course, the other way to rapidly increase population. However, opening our borders wide enough to quickly boost the population by 50-100% isn’t practical either. During our highest historical immigration periods, such as today, the percentage of foreign-born individuals has been about 15%. We would need to raise that to 30-50%, meaning that 1 in 2 or 3 people would be foreign-born. Again, this just isn't realistic.

Even more radical ideas, like merging countries, won’t work either. Canada has just forty million people (only about 10% of the U.S. population), and merging with anyone else with high output per person, such as Europe, would drag down our economy since they’ve been going slower than us in the race. Therefore, population growth is not our north star for navigating these uncharted waters, at least in the short-term.

Consequently, we are left with increasing economic output per person. Although three options are available to do so, only one is effective at the necessary scale. First, we can create net new jobs because unemployed people contribute zero economic output per person. However, we are already nearing full employment, so while it's likely that we can create some net new jobs, this effort won’t significantly boost our growth (speed in the race).

Second, economic output per person can be increased by having people work longer or faster, for example, through worker specialization. Unfortunately, this also has limited upside, given that Americans already work a lot (though admittedly less than China and India) and that our supply chains are already specialized.

The third and only way that will work well enough is to upgrade our jobs by giving workers much better tools, a.k.a technology. That’s because new technology increases worker productivity.

Think of how worker productivity increased in construction with the introduction of power tools and heavy machinery or in offices with the introduction of computers and the Internet. We need more of these, many times over: true leaps forward in technology applications that will dramatically increase our worker productivity.

In The Great Race metaphor, it’s oar-powered ships vs. sails vs. steam vs. nuclear. We need to be the ones pioneering the latest technologies so we can apply them first and most effectively.

With better technology, we can produce more with the same number of workers. More output per person means more dollars per person, which means more money changing hands and a bigger pie (economy) for everyone.

In other words, the only way for us to continually stay ahead in The Great Race is to maintain a long-term worker productivity advantage, many times that of China and India, to balance against their much greater populations (crews). And the only way we can do that sustainably is to invest decisively in an innovation advantage such that we are again indisputably technologically dominant, as far as the eye can see.

On Other Objections

Note that I have already addressed some objections above, including why investing in innovation won’t increase debt in the long term.

Isn't China having its own growth problems?

Yes, China isn’t perfect, and their current problems are our best opportunity to gain on them. If it wasn’t for their political and policy missteps of the past, like their disastrous one-child policy, they might be utterly uncatchable by us at this point already. Make no mistake, though: China is projected to navigate this current crisis and continue growing significantly faster than we are, partly supported by their still huge population. If we don't act soon, we risk reaching the point of no return in our efforts to catch up with them unless they experience a true meltdown of their own making. While that is always a possibility, we shouldn’t bet our future on it. And there is also India.

But I read an article saying China’s economy isn’t close to catching ours.

The typical method for measuring the size of an economy involves summing all the goods and services sold in a year, known as Gross Domestic Product (GDP). This results in a monetary value expressed in the country's currency, such as dollars for the United States or yuan for China. So, how do we compare them? A common yet problematic approach often reported is to convert one currency to the other using the current market exchange rate. However, this overlooks the significant price variations for the same goods and services across different countries. For instance, $1,000 can buy you considerably more in China than in the U.S.

Accounting for this difference is crucial when comparing the U.S. to China in the context of The Great Race, as China’s domestic investments will primarily be made in their currency rather than in dollars. For instance, when they hire soldiers and researchers, China will pay them, and these workers will, in turn, purchase food and housing in yuan. If China can employ 30% more workers because everything is cheaper there compared to the U.S., their economy is effectively 30% larger since those workers produce 30% more goods and services. Consequently, economists make “purchasing power parity” (PPP) adjustments to account for these differences.

If you don’t make any PPP adjustments, the U.S. economy still appears larger than China’s by about the same margin that China’s economy appears larger than the U.S. economy if you do make such adjustments. However, if you examine the rate of change in either method, you will notice that China's growth is outpacing that of the U.S., and that is the key point. As long as China’s GDP per capita continues to grow faster than ours, we will ultimately lose our position in The Great Race and will find it difficult to catch up to them because of the significant population difference. And if, for some reason, China completely stalls, which we shouldn’t leave to chance, there is also India gaining on us, with an even larger population than China.

I understand the appeal of wanting to still assert that the U.S. is ahead. After all, the main purpose of this essay is to ensure American hegemony. However, claiming we’re ahead when we are not what is causing us to fall further behind. We must acknowledge our vulnerable position and strengthen it. And just being a little ahead won’t ultimately get us what we want. We need to be way ahead in The Great Race.

But shouldn’t we care about GDP per capita (person) and not overall GDP?

Some countries have very high GDP per capita but almost no power on the world stage, so they will not challenge China. The size of the economy matters and is a major reason our currency dominates globally. More to the point, if not us, then who?

But why should I be scared of a future China when we have nuclear weapons?

Think about a much superior technological civilization with sci-fi stuff like quantum weapons and who knows what else. I wouldn’t bet our lives that there isn't a way to neutralize our nuclear weapons, for example, by intercepting and re-routing them or shutting them down somehow before they detonate. We will need to be masters and pioneers of new military technologies.

Doesn’t all of this seem a bit too anti-China?

No, the concern is about future Chinese governance, not the Chinese people, many of whom are likely opposed to their government. At the highest level, if China were another country entirely, I would still think we need to invest to stay ahead in the Great Race for all the benefits in standard of living and future security it brings.

OK, but I still don't care about growth. I care about happiness. Growth, for growth’s sake, is stupid.

I don't care about growth for growth's sake, either. I care about real scientific breakthroughs that can be applied to create authentic, positive impacts on society and collectively increase our standard of living. Right now, those types of outcomes are highly correlated to GDP per capita, but if that correlation ceases to hold, or if there are better ways to measure things, then great.

But why now? Hasn’t the same investment suggestion applied before?

It’s urgent now precisely because we are neck-in-neck with China in The Great Race. As noted above, if we let China get well ahead, we’ll have difficulty catching up due to its much bigger population. That said, yes, it is true that the same investment suggestion applied before now. If we had been applying it consistently, we probably would still be ahead now, and all be experiencing a much higher standard of living.

Is it too late if China is already investing in scientific research and technology development?

No, because today, our private sector, universities, and other research institutions are still second to none. But it will be too late if we don't step up now because that can change if China starts investing way more than us year after year, as they have been doing.

Is this all about AI?

No, I started writing this essay before ChatGPT was released and have been broadly considering the topics that led to it for over twenty years, starting from grad school. AI is clearly an essential technology in the context of The Great Race, particularly artificial superintelligence, but it is just one of many academic fields and technologies we must lead.

Is this a partisan issue (Democrat or Republican)?

No, it’s not. If you consider that we haven’t adequately invested in R&D for over half a century—a period that encompasses roughly a dozen presidents and ten economic cycles—it suggests that neither party has made any significant progress in this area over all that time, despite declining productivity growth.

Additionally, if you believe (as I do) that we need to increase our R&D investment levels and sustain them consistently for decades—across numerous future administrations and economic cycles—it will require bipartisan support, similar to the bipartisan support for our military funding.

But why can't the private sector do this without the government? Isn’t the success of our tech sector proof that it does already?

The private sector is essential to this strategy and is excellent at taking established scientific breakthroughs and turning them into products over a few years. That’s because there is a clear profit motive in doing so. However, it is not as great at coming up with those scientific breakthroughs in the first place or commercializing them on much longer timescales like decades, where the profit motive is significantly reduced. This activity still generally involves some government-funded research in the early stages.

Of course, sometimes the private sector can do it all, but it is not enough, as evidenced by China seemingly matching our pace of innovation in key technologies. However, it should be noted that the private sector—established and new companies—could do most of the work we’re talking about if we incentivize and invest in them properly, and that would be great. For instance, a significant portion of our investment could be allocated to direct funding for companies to pursue research with speculative profits. We can also create a more attractive regulatory and investment environment where pursuing such activities in the private sector makes more sense from a profit perspective.

But isn't the government wildly inefficient?

As noted, the government doesn’t need to pursue these activities solely; it just needs to fund them adequately, which could involve grants, loans, and investments in private sector organizations. That said, yes, the government is often inefficient, but that doesn't stop us from investing in our military, and it shouldn't stop us from investing in technological innovation, either. That’s just the cost of the government doing anything.

Separately, I'd love to make government more efficient. Let's work towards that, but it doesn't follow that because the government is inefficient, it shouldn't fill gaps that the private sector can’t fill without government support, like the military or fundamental scientific research.

There is inefficiency, and then there is failing to get the job done. For example, the government invested over $500 million in Solyndra, which ultimately went bankrupt.

When pursuing frontier research and development, not everything will succeed. That’s simply the nature of scientific inquiry and high-risk, high-reward investments in the future. If we allow a few failed projects to deter us from making adequate investments, we will undoubtedly lose The Great Race to China. We must be willing to place many bets on various future technologies in the hope that some will lead to significant breakthroughs.

As noted above, we need to invest about $500 billion more a year, which is 1,000 times more than the Solyndra investment. In other words, that investment is a rounding error in the grand scheme of things. Nevertheless, we must learn from our successes and failures and continually refine our processes for government investments and incentives to ensure their increasing likelihood of success.

Can you give concrete examples of how we could increase funding efficiently?

Sure, the National Science Foundation awards about $3.5 billion in grants annually, but its funding rate is only 26% because it is limited in the funds it grants, not by the number of quality applications it receives. The median grant size is relatively low, at around $200K. This funding rate and median grant size could easily be doubled to increase the number of quality grants by 4x, amounting to an additional $10.5 billion in R&D expenditures that would be disbursed efficiently. Another doubling to $20 billion could likely easily be made without compromising quality once it is widely known that higher grant amounts for more ambitious projects are available.

That’s just one R&D line item. A similar situation exists in the Small Business Research Programs (SBIR & STTR). Eleven federal agencies set aside a small portion of their budgets for grants to small businesses for research and development, totaling around another $3.5 billion. By the same logic, this could easily take another $10-20 billion. If you look at where we spend federal research and development dollars, potential increases like this abound.

In addition, we could undertake more ambitious (and expensive) new projects via public-private partnerships. For example, the largest particle accelerator, the Large Hadron Collider, is in Europe. Why? because we killed a similar project in the 1990s. However, it’s not too late to create the next-generation collider. That question can be asked in every field, not just physics. Namely, what’s the most ambitious thing we can do or build in this field to keep us ahead?

But doesn’t scientific knowledge spread instantly globally via the Internet?

While scientific breakthroughs can spread quickly, technological dominance relies on applying, scaling, and diffusing those breakthroughs more rapidly than others. To achieve this, you need a robust ecosystem for innovation spanning research, development, and commercialization. If done right, this ecosystem can sustain an edge despite global access to foundational knowledge.

This endeavor entails cultivating leading-edge institutions that continuously attract the best talent to improve increasingly complex technological processes, fostering an endless cycle of reinvention. Additionally, government policy can hinder the spread of essential processes and technologies in other countries. For instance, the basic science behind nuclear weapons has been established for eighty years, yet only a few countries have mastered the technology.

I don’t care about technology, which has arguably caused several serious societal ills recently.

Technology is the application of science to make things we can use. It is not inherently good or evil but can be used for both. As such, it needs to be adequately regulated, which we’ve failed to do recently, for example, by not enacting a general federal privacy law. However, that’s a governance problem, not a technology problem. We still need technology to increase productivity and our standard of living, as it is the fundamentally limiting factor of progress in both. For example, we wouldn’t want to roll back medical advances because similar technologies could also be used for bioweapons. Instead, we should attempt to control a medical technology’s potential for bioweapons while still getting its quality-of-life improvement.

OK, but I don’t want the concentration of power and wealth to become even more concentrated in the same companies.

I don’t want that either. Broadly, funding and incentivizing much more frontier research and development should ultimately create more new businesses and, therefore, more disruption of existing ones. Additionally, by allocating a decent portion of that investment directly to smaller organizations, we can better ensure that disruption occurs and that it creates new jobs.

Fine, but what about inequality? I don’t want that to increase further, either.

Pioneering and developing new technologies in America means creating higher-paying jobs in America using these new technologies, which, if we do enough of it, should lower inequality, not increase it. However, parallel investment will be required to ensure Americans are adequately prepared to work these jobs, for example, in education. And, again, investing a significant portion in private organizations can better ensure job creation.

I don’t care about American power. In fact, America hasn’t always made the best choices in foreign affairs.

Yes, America isn’t perfect, but do you want autocracy to be the dominant form of government globally? Because that’s where we’re headed right now. On a country-by-country basis, it’s already 50/50, with all forms of democracy recently on a steep decline and access to democratic freedoms declining on a population basis overall. A dominant China and India (which has become more autocratic) will hasten these trends. And if China (or India) decides to become imperial, who exactly will stop them if not America? We won’t be able to do so if we are behind technologically.

Additionally, people underestimate the soft power dividends we receive as a country because our currency is the dominant reserve currency. We believe our ability to control inflation and interest rates is inadequate now—most other countries have much less control. Given our dominance, what we do has an enormous knock-on effect on their currencies. If the yuan becomes the dominant currency, we will experience similar knock-on effects from China's actions, not vice versa.

Why are you qualified to give opinions on this topic?

I hope The Great Race is compelling on its face, not requiring the author's credentials to make it convincing. That said, my graduate degree in technology policy and career has certainly helped educate me about this issue. See my personal website for more.

So, you’re some kind of “tech bro”?

No, I’ve primarily spent my career advocating for individual privacy rights, often opposing the largest tech companies. I also don’t live in Silicon Valley (or any tech hub). Nor do I espouse “bro” values.

When was this initially published?

Jan, 2025.

What about this or that nuanced point you didn’t adequately address?

Nuanced points on this subject could quickly fill an entire book. I've chosen not to do that since I thought a shorter piece would get the basic argument out there further and faster. However, I am interested in all the points, so please feel free to reach out. I’d love to improve this essay further and, of course, correct any errors.

Let me leave you with what I think are the core premises you need to believe to support the central argument that we must dramatically increase federal investment in frontier research and development.

- China and India have populations significantly bigger than the United States, and this difference is likely to persist for the rest of this century, even as China’s population ages and decreases.

- China and India have experienced faster economic growth than the United States for decades, and this trend is expected to persist for several more decades, even as China’s economy begins to slow down.

- Creating new technology is the main long-term factor in boosting worker productivity and, consequently, raising economic output per person (GDP per capita).

- China has consistently increased its R&D spending as its economy has grown, and India is beginning to follow suit. China’s R&D spending is already nearing that of the U.S. on a PPP basis, and its overall economy has surpassed that of the U.S. on a PPP basis.

- If China’s economy doubles or triples that of the United States, this gap could lead to serious repercussions for the U.S. These may encompass, but are not confined to, China’s capacity to outspend the U.S. in military and technological advancements, the weakening of the dollar as the world’s reserve currency, and the reduction of the U.S. as the dominant business and financial market.

In the metaphor of The Great Race, if we are roughly equal in technology, China and India will prevail due to their bigger crews (populations). Therefore, we need superior technology to succeed, and the way to get that technology is by investing in its discovery and development. Given our smaller population, we must invest more to get ahead, and currently, we are not doing enough. Hence, we need to dramatically increase our investment.